Our modern economy has made tax filing increasingly complex. From cryptocurrency trades and side hustles to unemployment benefits and investment gains, Americans face a growing list of potentially taxable situations that can lead to unexpected costs during tax season. Even with the rise of tax software and a wealth of other online resources, many people find themselves surprised by what they owe on tax day.

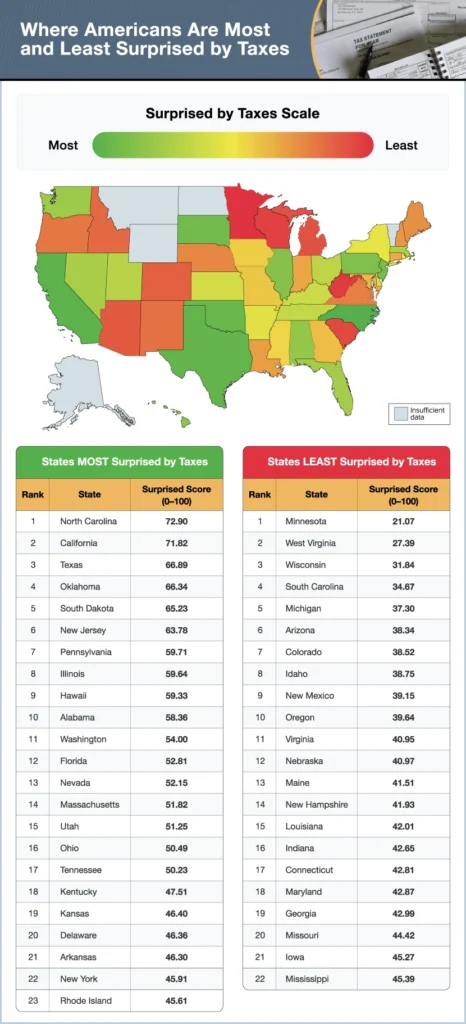

With the 2025 tax deadline approaching (a little too quickly), the team at Bitcoin Postage wanted to understand where Americans are most caught off guard by their tax obligations. We surveyed residents throughout the country about their tax knowledge, experience with surprise tax bills, and awareness of various taxable situations. Using their responses, we created a “surprised by taxes” score from 0 to 100, ranking U.S. states based on how surprised their residents are when it comes to tax season.

The results reveal significant gaps in tax knowledge across different states, demographics, and financial situations. From crypto traders facing unexpected capital gains taxes to freelancers learning about self-employment obligations, Americans everywhere are grappling with the complexities of our tax system. Read on for the full details behind where taxpayers are most likely to face surprising bills this April.

Key Takeaways

- North Carolina, California, and Texas residents are most likely to be surprised by taxes.

- Minnesota, West Virginia, and Wisconsin residents are least likely to be surprised by taxes.

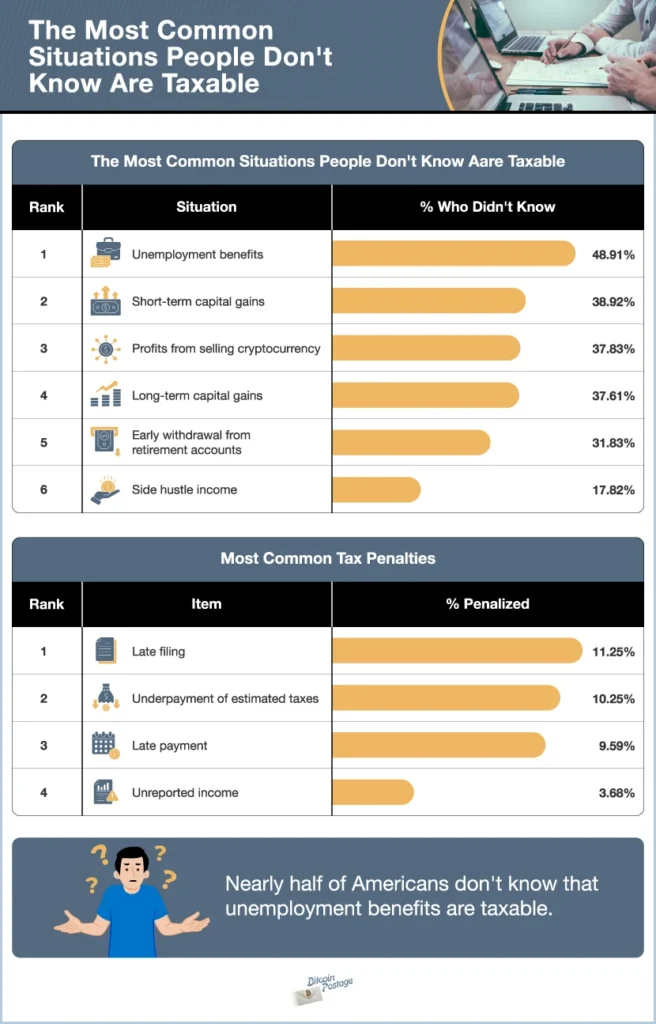

- Nearly half of Americans don’t know that unemployment benefits are taxable.

- Over a quarter of Americans have been surprised by self-employment taxes in the past.

- Late filing and underpayment of estimated taxes are the most common ways Americans get penalized when filing taxes.

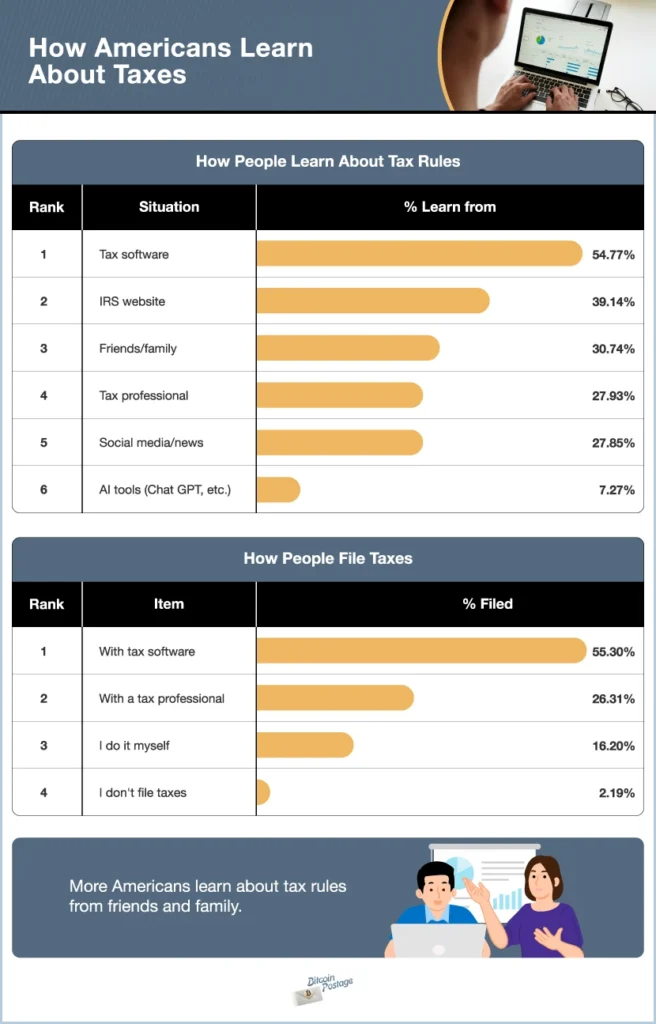

- 55% of Americans file their taxes via tax software.

- More Americans learn about tax rules from friends and family than from tax professionals. Additionally, 28% of Americans learn about tax rules from social media, while 7% use AI tools like ChatGPT.

Where Americans Are Most and Least Surprised by Taxes

Among states the most likely to be surprised by taxes, North Carolina (#1), California (#2), and Texas (#3) rank at the top. North Carolina and California residents are particularly surprised by unexpected taxes — they were the only two states to break 70 on our surprised score. Texas neighbor Oklahoma ranks fourth, while South Dakota caps the top five. New Jersey, Pennsylvania, Illinois, Hawaii, and Alabama are the remaining states in the top 10.

Meanwhile, northern midwest states Minnesota (#1), Wisconsin (#3), and Michigan (#5) occupy three of the top five spots for states least surprised by taxes. The other two in the top five include West Virginia (#2) and (North Carolina neighbor) South Carolina (#4). Western states Arizona, Colorado, Idaho, New Mexico, and Oregon round out the top 10 least surprised states, ranking 6th through 10th, respectively.

Wisconsin residents were particularly tech-savvy as 77% of them knew that crypto transactions are subject to taxes, a percentage that’s more than any other state. On the flipside, just 43% of Floridians knew that crypto is taxable. Continuing on the surprise trend, 21% of New Yorkers have owed surprise taxes on crypto, more than any other state.

The Most Common Situations People Don’t Know Are Taxable

The results of our survey highlight a common theme: Many Americans don’t realize what they owe until it’s too late. Over a quarter of Americans have unexpectedly owed $3,000 or more on taxes, and nearly half don’t know unemployment benefits are federally taxable. On top of that, over a quarter of Americans have been surprised by self-employment taxes in the past.

Meanwhile, the most common tax penalties include late filing and underpayment of estimated taxes.

Moving on to gender differences, men are 6% more likely to feel confident about their tax knowledge than women, and 30% of men have changed their financial habits to avoid surprise taxes — just 22% of women have done so. However, 11% of men have owed surprise taxes on cryptocurrencies, compared to just 4% of women. Pew Research found that 25% of men have invested traded or used crypto vs just 10% of women.

At the generational level, millennials are the most likely generation to be surprised by taxes on cryptocurrencies, with over 10% owing surprise taxes after selling crypto. That beats out Gen Z (8% have owed surprise crypto taxes) and Gen X (5%).

How Americans Learn About Taxes

More Americans learn about tax rules from friends and family (31%) than from tax professionals (28%). Additionally, 28% learn about tax rules from social media, while 7% use AI tools like ChatGPT. Gen Z is particularly into learning about tax rules from AI — 11% of that generation has done so. Meanwhile, 37% of baby boomers learn about tax rules from a tax professional, which is 10 percentage points higher than any other generation.

Beyond specific learning methods, 55% of Americans never or rarely look at tax rules, while Gen Z as a whole is 26% less confident about their tax knowledge than other generations.

When it comes to actually filing taxes, 55% of Americans use tax software, and 26% file with a tax professional. Men are more likely to use tax software, while women are more likely to use a tax professional.

Taxes Are Complicated, but Shipping Shouldn’t Be

Tax season can feel like a maze of regulations, deadlines, and unexpected costs. Whether you’re dealing with investment income, cryptocurrency trades, or self-employment taxes, the complexity grows each year. For many Americans, doing taxes is almost as annoying as paying them.

However, sending packages to friends, family, or customers should never be a complicated source of stress.

That’s where Bitcoin Postage comes in. With us, you can easily buy and print postage quickly using Bitcoin — and you can track packages, too. Between the numerous carriers we offer and the ability to print labels from the comfort of your home, shipping has never been simpler. So let us handle the shipping logistics while you focus on navigating tax season’s challenges.

Read more Bitcoin Postage research studies here.

Methodology

In this study, we set out to learn where Americans were most surprised by taxes. To rank states, we surveyed 2,457 people across the country asking them how confident they are about understanding taxes, if they’ve ever been surprised by what they owe, if they were worried about the upcoming tax season, and which situations they knew were taxable. Answers to these questions were combined into a 0 to 100 score, with 100 being the most surprised and 0 being the least surprised.

Alaska, Montana, North Dakota, Vermont, and Wyoming were omitted due to lack of responses.