Whether knowingly or not, many people have taken part in doom spending. When feeling stressed out or anxious about their financial future or global issues, many Americans turn to impulsive or irresponsible spending on short-term pleasures. This can include anything from dining out to travel, but it can result in major financial consequences if done too frequently.

Overall, 67% of Americans say the uncertainty of the world makes it harder for them to focus on long-term savings or financial goals. Unfortunately, we have no way to predict the future, so we all experience this anxiety at one point or another in our lives.

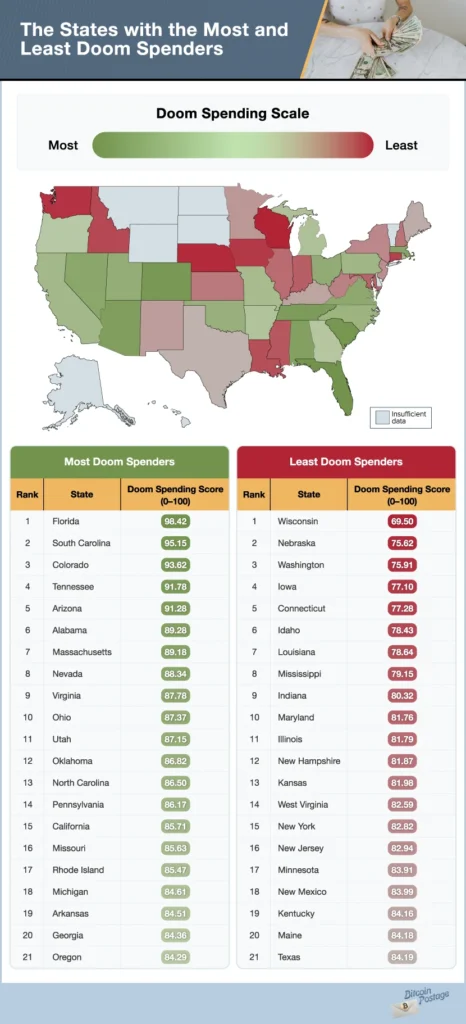

With this in mind the team at Bitcoin Postage set out to learn where Americans are diving into doom spending the most and where people are trying to remain more mindful of their long-term financial goals.

We surveyed residents in every state to learn how often they doom spend, what factors in life cause them to spend, what they spend the most on, and more. Using this data, we created a doom spending score on a scale of 0 to 100, with 100 representing the most doom spending. Read on to see how your state ranks among the rest.

Key Takeaways

- Florida, South Carolina, and Colorado have the most doom spenders.

- Wisconsin, Nebraska, and Washington have the fewest doom spenders.

- 72% of Americans have spent money based on feelings of doom or anxiety about the future.

- 1 in 4 Americans say they made impulsive or irresponsible spending decisions based on feelings of stress or anxiety about the 2024 presidential election results.

- Concerns about economic instability, stress from family issues, and high living costs are the most common factors that drive Americans to doom spend.

- Food, entertainment, and clothes are the top three items Americans spend most on when feeling anxious or stressed.

Where the Biggest Doom Spenders Live in the U.S.

Every day, emotions prompt people to spend money. While we happily spend money celebrating life’s joys, negative emotions can also unleash our purchasing power in an effort to soften life’s blows. In fact, 72% of Americans have spent money based on feelings of doom or anxiety about the future. While you may not spend more when you feel anxious compared to when you’re happy, negative emotions have a way of bypassing your logic and pushing you to spend money on things you probably shouldn’t.

All across America, people often set aside their better judgment and make poor financial decisions based on feelings of doom or anxiety. However, some residents do so more than others. People in Florida, South Carolina, and Colorado doom spend the most.

In Florida and Colorado, residents are the most likely to say that the fear of not being able to retire drives them to doom spend. In South Carolina and Alabama, residents are the most likely to doom spend due to high living costs. While money fears cause some in Florida to doom spend, residents of Florida and New Hampshire both are most likely to say that frustration over political issues encourages their doom spending.

Besides geographical location, your likeliness to doom spend can also depend on your gender. Women are more likely than men to spend money based on feelings of doom or anxiety about the future.

Spending money to offset one’s mood is least likely to occur among residents of Wisconsin, Nebraska, and Washington, where people doom spend the least. People in these states are least likely to spend recklessly and instead do a better job of keeping their financial future in mind when making purchases.

What Causes Americans to Doom Spend

While some Americans often spend their money impulsively and irresponsibly based on feelings of doom, understanding why they do so, requires us to take a deeper look. For the majority of Americans, concerns about economic instability, stress from family issues, and high living costs are the most common factors that drive them to doom spend. In fact, over half, 52%, say concerns about economic instability cause them to doom spend.

Recently, politics drove many Americans to spend money they weren’t planning on spending. One in four Americans say they made impulsive or irresponsible spending decisions based on feelings of stress or anxiety about the 2024 presidential election results. Beyond the election results, more than a third of Americans say overall frustration over political issues drives them to doom spend. A common political issue that raises fears is the topic of climate change, causing 1 in 5 Americans to doom spend.

Personal issues and challenges also impact Americans’ buying habits. Half of Americans say their doom spending is caused by stress from family issues, and 2 in 5 do so because of stress about their health. The struggle of not being able to cover basic bills drives more than two-fifths of Americans to make irresponsible spending decisions. One of Americans’ largest bills is their rent or mortgage, and 1 in 3 people say they fear they can’t afford a home. Another large expense is student loan debt, and 1 in 5 Americans say their doom spending results from stress about their student loan debt.

Facing stress over bills, health, and other current struggles can lead to fears of an unpredictable future, which is another reason Americans doom spend. One in three Americans say worries about not affording a home drives them to doom spend, and more than a third of Americans say uncertainty about job security drives them to doom spending. While retirement can sound freeing and relaxing to some, thoughts about their post-work future make others anxious. Nearly one in three Americans say the fear of not being able to retire drives them to doom spend.

Additionally, the stress of needing to appear a certain way causes Americans to make irresponsible purchases, as more than a third of Americans succumb to doom spending when feeling pressure to appear successful. With social media influencers and friends continually advertising a certain lifestyle and the products you need to achieve it, the desire to keep up with your peers can easily lead you to prioritize short-term gratification over long-term financial stability. Realizing your triggers for doom spending and having a set plan in place to achieve happiness without compromising your finances can lead to a more healthy financial future.

The Items Americans Doom Spend on the Most

When anxiety or stress kicks in, many Americans develop a “treat yourself” mindset and indulge in short-term comforts that offer immediate relief. In fact, 1 in 7 Americans say their mood drives their spending decisions very often. The top things Americans spend most on when feeling anxious or stressed are food, entertainment, and clothes.

Whether it’s grabbing takeout after a long day or indulging in their favorite meals, food often becomes a source of comfort, which is why 82% say they spend the most on food when anxiety or stress hits. Beyond taking comfort through food, many people want to disassociate from their current stressors and focus on something else. Nearly a third of Americans say they often spend money on things that bring temporary joy as a way of coping with the pressures of life. To lift their mood, 62% say they spend the most on entertainment when anxiety or stress creeps in, and 43% say they spend the most on clothes. Another source of temporary joy is experiences, and more than two-fifths of Americans say they spend the most on experiences when feeling anxious or stressed.

If after a rough day, you’ve ever found yourself at your favorite store or adding items to a cart on your favorite retail website to feel better, you’re part of the nearly two-thirds of Americans who have practiced “retail therapy.” More than a third say they spend the most on electronics when doom feelings hit. Beauty products can also be therapeutic, and nearly 1 in 3 Americans say they spend the most on beauty items when feeling anxious or stressed.

Some people need to physically get away to feel better, and nearly 1 in 4 say they spend most on travel when feeling anxious or stressed. If their PTO doesn’t grant them the ability to jet off, Americans will still feel better going out on a local level. One in six Americans say they spend the most on nightlife when feeling the urge to doom spend.

Whether it’s splurging on a new outfit, grabbing a treat, or exploring somewhere new, Americans frequently doom spend on items or experiences that can lift up their mood temporarily. However, the short-term relief often fades, which results in the vicious cycle of spending more money to feel joy again.

At the end of the day, Americans are left with the financial and emotional consequences of impulsive spending, which is typically the mood they were spending money to get rid of — anxiety or stress. When they sit down and take a peek at their finances, nearly 2 in 5 Americans say they often get anxious or stressed when thinking about their financial situation.

Conclusion

From paying student loans or credit card debt to covering the cost of unexpected expenses or saving for the future, we have many financial obstacles we encounter throughout our lives. One way to better prepare ourselves for the unknown is by focusing on long-term financial goals now.

Whether you decide to focus on establishing an emergency fund, tracking spending more closely or even investing in stocks or cryptocurrency, the choices you make now can help pave the way for your future.

If you are among those who have entered into the cryptocurrency world, we at Bitcoin Postage are here to help you utilize that currency to make mailing easier than ever. By simply entering the dimensions, weight, and shipping information, you can buy and print postage with Bitcoin in a flash.

If you are among those who have entered into the cryptocurrency world, we at Bitcoin Postage are here to help you utilize that currency to make mailing easier than ever. By simply entering the dimensions, weight, and shipping information, you can buy and print postage with Bitcoin in a flash.

Methodology

In this study, we set out to learn where Americans are doom spending the most. To do this, we surveyed 2,294 Americans across the country regarding their spending when feeling anxious or stressed. We asked a variety of questions from how frequently they do it, what factors drive the spending, what they spend the most on, and more.

Using these responses, we awarded points to answers that represented doom spending and then calculated the average score for each respondent. Then we calculated the average score by state based on residents’ scores and adjusted those scores on a scale of 0 to 100, with 100 representing the most doom spending. Finally, we ranked states from the most to least likely to doom spending.

Due to a lack of responses, Alaska, Delaware, Hawaii, Montana, North Dakota, South Dakota, Vermont, and Wyoming were excluded from this study.